Updated mortgage interest rates for buying houses

When it comes to buying a house, a home loan is almost always part of the process. But which bank offers the best mortgage rates? To make things easier, our team has gathered the updated mortgage interest rates for February 2017 from leading banks in Thailand, including Kasikorn Bank, Siam Commercial Bank, Bangkok Bank, Krungthai Bank, Government Savings Bank, TMB Bank, and Krungsri Bank. This comparison will help you see which banks provide the lowest interest rates and the conditions that come with them—making it easier for homebuyers and condo buyers to make informed decisions. We’ve also included a handy mortgage calculator to help estimate monthly repayments.

In general, home loan interest rates don’t change very frequently—usually once per quarter or every six months. However, adjustments depend on each bank’s internal factors and policies.

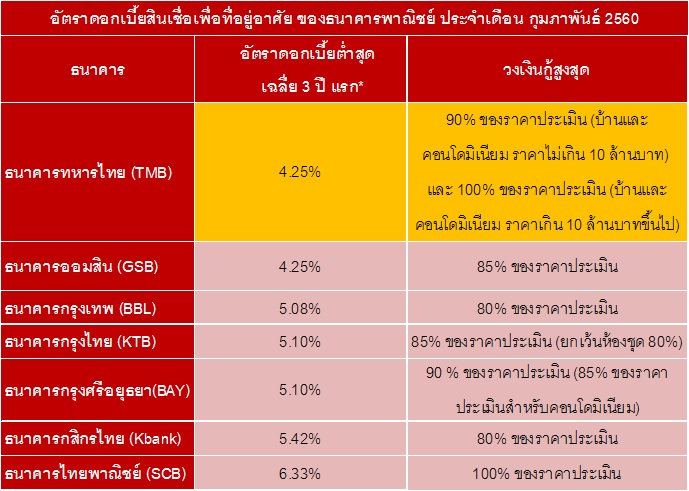

As of the second month in Q1, most banks still maintain their existing housing loan interest rates. Among commercial banks, Bangkok Bank (BBL) continues to offer the lowest rate at 5.08% (under specific programs). On the state-owned bank side, TMB Bank leads with the lowest rate of 4.25%. Below, we’ve summarized the mortgage rates from other banks for February 2017.

Updated mortgage interest rate table for houses & condos – February 2017

Note: The average mortgage rate for the first 3 years is calculated using a mathematical average.

This month, two banks stand out for offering the most competitive interest rates—TMB Bank and Government Savings Bank—with maximum loan-to-value (LTV) ratios of up to 85–100% of the appraisal price.

Breakdown of lowest average 3-year mortgage rates

- TMB Bank: Year 1 = 4.25%, Year 2 = 4.25%, Year 3 = 4.25%. → Average = 4.25%

- Government Savings Bank: Year 1 = 1.25%, Year 2 = MRR-2.00%, Year 3 = MRR-0.75%.

(MRR = 7.125%) → Average = 4.25%

Sources: ddproperty.com

LIVING CONSULTANT

หนี้ที่มีผลกับการกู้คอนโด และการกู้ให้ผ่านเมื่อมีหนี้

วิธีตรวจสัญญาเวลาโอนบ้าน โอนคอนโด

Should You Buy or Build a Home?

HOW TO INVEST IN CONDO FOR RENT